College Craze: Why Student Housing Might Be Your Investment Goldmine

The real estate market can be a fickle beast, with trends shifting and opportunities hiding in plain sight. But one sector consistently shines — student housing. Forget fleeting vacation rentals or volatile commercial spaces — investing in apartments near universities offers a unique blend of stability, high returns, and a vibrant community to boot.

Now, before you dismiss this as “dorm life for rich kids,” hear me out. Student housing isn’t just about bunk beds and ramen noodles. It’s a multi-billion dollar industry fueled by a reliable tenant base: future doctors, lawyers, and entrepreneurs who need a place to call home during their academic journey.

Why College Towns Make Investment Havens:

Built-in Demand: Unlike traditional markets where vacancies can fluctuate, college towns guarantee a steady stream of potential tenants. Every year, a fresh wave of students arrive, seeking accommodation. This predictability minimizes vacancy risks and ensures consistent income.

Sticky Tenants: Unlike transient renters, students typically stay put for multi-year leases, often coinciding with their degree programs. This reduces turnover costs and fosters a sense of community within your property.

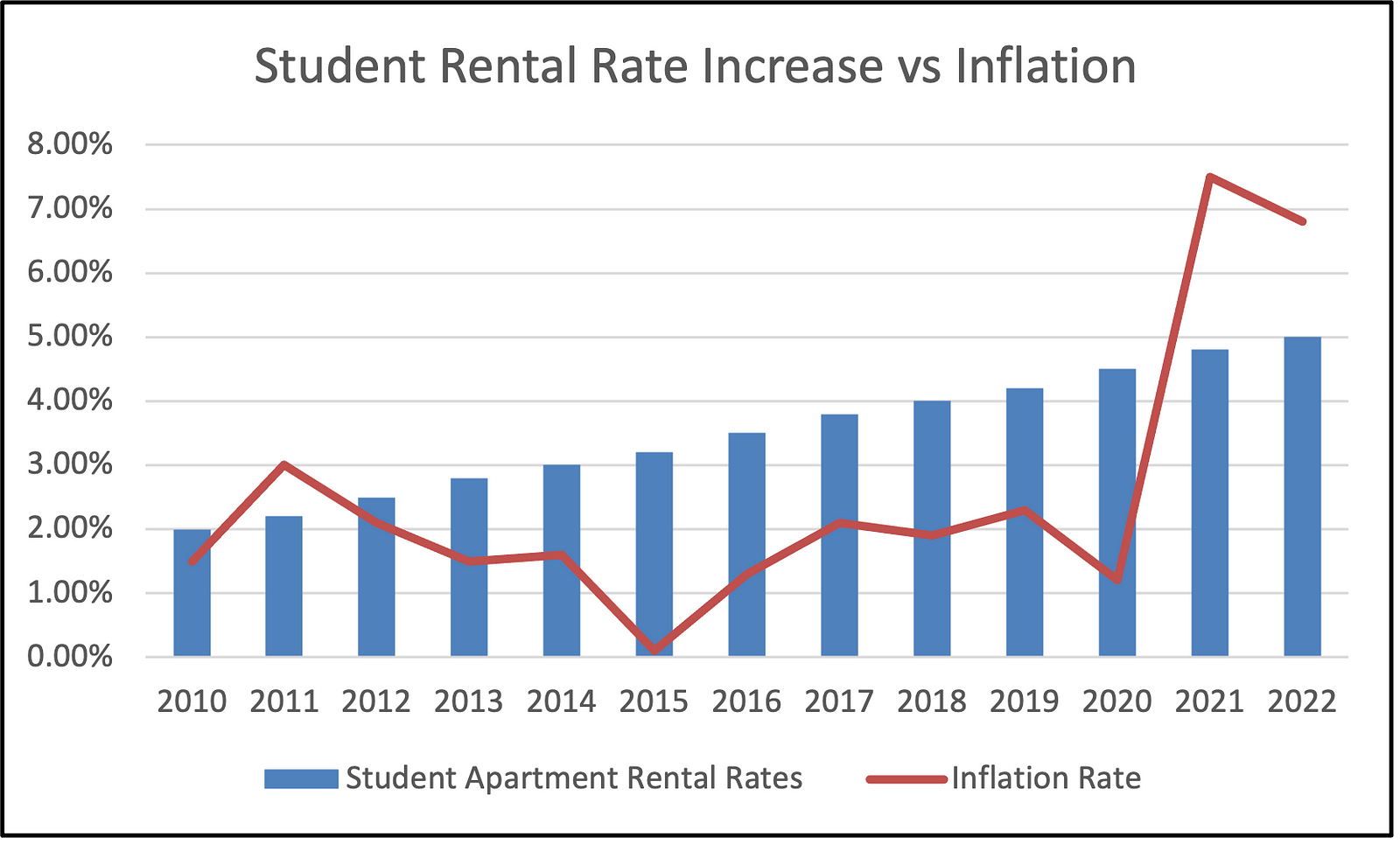

Inflation Hedge: Student rents tend to outpace inflation.

The rising cost of education often translates to increasing housing demand, allowing you to adjust rents accordingly, mitigating inflation’s impact on your returns.

Beyond the Numbers: It’s not just about the cold, hard statistics. Consider the dynamic nature of the student market. With rising tuition costs, students and their families are often willing to spend more on quality housing, pushing average rental rates upwards. This upward trend often outpaces inflation, offering a natural hedge against its effects.

Diversification: Adding student housing to your portfolio diversifies your investments, reducing overall risk and spreading your eggs across different market segments.

The Numbers Don’t Lie:

Statistics paint a convincing picture. According to the National Student Housing Report, the average occupancy rate for student housing hovers around 95%, significantly higher than the national average for traditional rentals. Additionally, rental income in college towns often grows 2–3% above inflation, making it a strong hedge against rising costs.

Student Housing vs. Multifamily Rentals

Student housing rental rates have outpaced multifamily rentals in recent years. From November 2022 to May 2023, purpose-built student housing rents increased by an average of 8.8 percent year over year, while multifamily rents grew by only 4.5 percent. The trend coincides with students returning to in-person classes after pandemic-related closures. As colleges burst with students, the demand for off-campus housing remains strong.

What Students Want

Attracting and retaining college-student renters requires finesse. Here are some tips:

- Proximity Matters: Students want to roll out of bed and into class. Invest in apartments within walking distance of campus.

- Amenities Count: Think high-speed internet, study lounges, and fitness centers. Students appreciate convenience.

- Safety First: Secure buildings and well-lit areas are crucial. Parents want their kids to feel safe.

But It’s Not Just About Money:

While the financial benefits are undeniable, owning student housing offers more than just cold, hard cash.

You become part of a vibrant community, contributing to the lives of young people during their formative years. Providing quality housing can impact their academic success and overall well-being, fostering a sense of connection and responsibility.

Navigating the Student Scene:

Of course, not all college towns are created equal. Conducting thorough research is crucial. Here are some key factors to consider:

University Size and Reputation: Larger, well-established universities with stable enrollment numbers offer greater security.

Location: Proximity to campus, amenities, and public transportation significantly impacts rental demand and pricing.

Local Rental Market: Analyze existing student housing options, rental rates, and vacancy trends to gauge competition.

Management Strategies: Consider professional property management companies specializing in student housing to ensure smooth operations and tenant relations.

Remember, it’s not just about bricks and mortar — it’s about understanding the student experience. Cater to their needs by offering amenities like study spaces, high-speed internet, and laundry facilities. Foster a sense of community through social events and resident engagement programs.

Investing in student housing isn’t a get-rich-quick scheme, but a strategic move for long-term wealth creation. With careful planning, research, and a commitment to providing quality housing, you can tap into a dynamic market with reliable returns and the satisfaction of contributing to young lives. So, are you ready to join the college craze and unlock the potential of student housing? The textbooks might be dusty, but the investment opportunity is shining bright.

What do you think? Is owning college-focused housing a good investment?